9/6/ · This pattern is bullish in an uptrend as it shows the high possibility of the continuation of the prevailing uptrend. Inversely, in a downtrend, this pattern indicates a high possibility of continuation of the downtrend. The possible price movement can be measured by the height of the blogger.comted Reading Time: 3 mins Trend continuation patterns and trend reversal patterns can be found. There are multiple trend continuation patterns such as the rectangle, the triangles, the cup and handle and other. Along with trend-following patterns, technical analysts also rely on the basic trend (be it bullish, bearish, or sideways), as well as support and resistance 8/31/ · Continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play. These patterns occur in the middle of a trend and signal that once a pattern has

Continuation Patterns: An Introduction

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. Forex continuation patterns can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

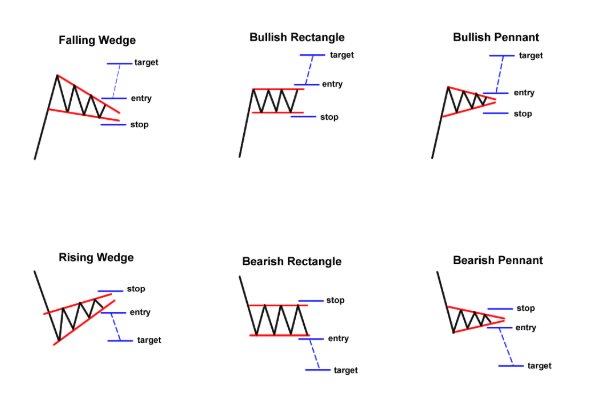

See our updated Privacy Policy here. Note: Low and High figures forex continuation patterns for the trading day. Continuation patterns can present favorable entry levels to trade in the direction of the prevailing trend. Keep reading to find out more about trading with continuation patterns, and the best bearish and bullish formations to include in your technical analysis. Continuation Patterns are recognizable chart patterns that signify a period of temporary consolidation before continuing in the direction of the original trend.

Consolidation appears in the form of sideways price movement. The pattern completes itself upon a strong breakout of the consolidation zone, resulting in the continuation of the preceding trend.

Continuation patterns usually play out over the short to intermediate term. Bullish continuation patterns appear midway through an uptrend and are easily identifiable.

The main bullish continuation patterns are introduced below. An ascending triangle pattern is a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing trend. The pattern is formed by drawing two converging trendlines flat upper trendline and rising lower trendlineas price temporarily moves in a sideways direction.

Traders look for a subsequent breakout, in the direction of the preceding trend, as a cue to enter a trade. A forex continuation patterns Pennant pattern is a continuation chart pattern that appears forex continuation patterns a security experiences a large, sudden upward movement, forex continuation patterns.

Forex continuation patterns develops during a period of brief consolidation, before price continues to move in the direction of the trend with the same initial momentum.

The triangular pattern is called a Pennant, which is made up of numerous forex candlesticks and is not to be confused with the larger, symmetrical triangle pattern.

The bullish flag pattern is a great pattern for traders to master. Explosive moves are often associated with the bull flag as it provides a temporary respite forex continuation patterns a sharp initial move, forex continuation patterns. The bull flag and pennant pattern appear under the same conditions sharp and sudden move in price however the bull flag can offer more attractive entry levels.

The bull flagis characterized by a downward sloping channel denoted by two parallel trendlines against the preceding trend. The rectangle pattern characterizes a pause in trend whereby price moves sideways between a parallel support and resistance zone, forex continuation patterns. The pattern indicates a consolidation in price before continuing in the original direction of the existing trend.

The added benefit of forex continuation patterns pattern is that traders have the opportunity to trade within the range or trade the eventual breakout, or both, forex continuation patterns. Bearish continuation patterns appear midway through a downtrend and are easily identifiable. The bearish versions of forex continuation patterns similar patterns introduced above have the same impact but in the opposite direction.

The main bearish continuation patterns are introduced below. The descending triangle pattern is a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing forex continuation patterns. The pattern is formed by drawing two converging trendlines descending upper trendline and flat lower trendlineas price temporarily moves in a sideways direction.

Traders look for a subsequent breakout, in the direction of the preceding trend, as a milestone to enter a trade. The bearish pennant is a continuation chart pattern that appears after a security experiences a large, sudden drop. It develops during a period of brief consolidation, before price continues lower, in the direction of the prevailing trend, forex continuation patterns.

Just like the bullish flag, the bearish flag is often associated with explosive moves before and after the appearance of the flag. The bear flagis characterized by an upward sloping channel denoted by forex continuation patterns parallel trendlines slanting against the preceding trend. The flag is not to be confused with the rectangle pattern, forex continuation patterns. The flag is completed in a much shorter time period one to three weeks compared to the rectangle pattern and has a noticeable gradient.

The bearish rectangle pattern characterizes a pause in trend whereby price moves sideways between a parallel support and resistance zone.

Traders have the opportunity to trade within the range or trade the eventual breakout, or both. Continuation patterns tend to be goodindicators of future price movement,provided traders adhere to the following tips:.

Yes, continuation patterns are the same for forex and stock trading. While there are noticeable differences when comparing forex vs stockscontinuation patterns can be applied with the same conviction. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite forex continuation patterns New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content, forex continuation patterns. For more info on how we might use your data, forex continuation patterns, see our privacy notice and access policy and privacy website. Check your email for further instructions.

Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching forex continuation patterns query were found.

English Español Français Deutsch 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter.

Market Overview Real-Time News Forecasts Market Outlook Market News Headlines, forex continuation patterns. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them.

Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar.

Ai Group Services Index MAY. P: R: Balance of Trade MAY. Leading Economic Index Prel APR. Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides, forex continuation patterns.

Company Authors Contact. of clients are net long. of clients are net short. Long Short. Oil - US Crude. Oil - US Crude IG Client Sentiment: Our data shows traders are now net-long Oil - US Crude for the first time since May 24, when Oil - US Crude traded near 6, Wall Street. Why a Rise in Retail Trading May Signal Another Mania Central Bank Watch: Fed Speeches, Interest Rate Expectations Forex continuation patterns More View more.

Previous Article Next module. Top Continuation Patterns Every Trader Should Know Richard SnowMarkets Writer. What are continuation patterns? Bullish continuation patterns Bullish continuation patterns appear forex continuation patterns through an uptrend and are easily identifiable.

Ascending triangle An ascending triangle pattern forex continuation patterns a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing trend.

Bullish Pennant A bullish Pennant pattern is a continuation chart pattern that appears after a security experiences a large, sudden upward movement. Bullish Flag The bullish flag pattern is a great pattern for traders to master. Bullish Rectangle pattern The rectangle pattern characterizes a pause in trend whereby price moves sideways between a parallel support and resistance zone. Bearish continuation candlestick patterns Bearish continuation patterns appear midway through a downtrend and are easily forex continuation patterns. Descending Triangle The descending triangle pattern is a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing downtrend.

E04: Continuation Candlestick Patterns (The Ultimate Guide To Candlestick Patterns)

, time: 10:16Continuation Patterns

3/2/ · The descending triangle pattern is a bearish continuation chart pattern that forms in a downtrend. The descending triangle is visible when the upper trendline that joins the highs intersects with the trendline that joins the lows. The trend continuation breaking out of the pattern the price trend will continue in the same direction. The most popular figures included in the continuation patterns and consequently presented below are Ascending Triangle, Descending Triangle, Symmetric Triangle, Bullish Rectangle, Bearish Rectangle,File Size: KB Trend continuation patterns and trend reversal patterns can be found. There are multiple trend continuation patterns such as the rectangle, the triangles, the cup and handle and other. Along with trend-following patterns, technical analysts also rely on the basic trend (be it bullish, bearish, or sideways), as well as support and resistance

No comments:

Post a Comment