Sep 09, · Account Risk = AR = the percentage of account size that you want to risk per trade. Example: If the AR=1% and your account size is $ then AR=$ I tried to relate AR to RRR as follows. This the maximum I wish to lose on a single trade Trade FX with a Demo Account. Whether your new or an experienced trader, a risk free demo account is a great way to experience the benefits of trading with blogger.com first hand. Trade with real money. Get started in less than 5 minutes. Open an Account Forex Risk Management The application of strong forex risk management principles requires equal parts planning and discipline. In this tutorial, you will learn how to identify, quantify and manage your risk exposure in live market conditions. Developing a Trading Plan

Understanding Forex Risk Management

Request a PDF version. The Forex markets are some of the most traded in the world, attracting an ever-increasing number of traders. The main reason why more and more traders flock to the Forex markets is that the barriers to entry to trading currencies are so low. All you need to start trading is a computer, a small amount of capital, an Internet connection to access your online trading platforms, and most importantly trading knowledge. As a Forex trader, risk is defined as losing money, there are four cornerstone risks that might make this occur.

Market risk, also called systematic risk, represents the risk inherent to the entire market, as opposed to the unsystematic risk that only affects a specific asset, market, sector, geographical region, etc.

While unsystematic risk can be reduced with diversification, systematic risk can not. Indeed, to make money in the market, you need prices to move around, so you can take advantage of the difference in prices when buying and selling.

Consequently, volatility is what allows you to make profitable trades. Systematic risks There are countless systematic risks that can affect prices:. Even though the Forex market is one of the most liquid financial markets in the world, there are periods of low liquidity.

Especially outside of the American and European trading sessions, or during bank holidays and weekends. This is an important risk that traders should take into consideration, as this usually means that their cost of trading will increase. Indeed, when brokers face a low liquidity situation, they usually increase the size of their spreads. Remember that a spread is the difference between the selling price and the buying price. Increasing trading costs is a situation that only happens when your broker offers variable spreads, forex account risk, which change depending on the market and trading conditions.

Did you know? When the Swiss central bank SNB decided to unpegged the franc and cut interest rates deeper into negative territory, markets were caught off guard. In the Forex market, the counterparty is the entity with which you open and close trading positions: your broker. This risk is quite difficult to measure as an individual trader, so they rely on regulatory bodies.

By using a trustworthy broker that is subject to regulation from a reputable authority, you can be more confident when trading. Securities and Exchange Commission SEC in the U. Not only should you be sure to work with a licensed and regulated brokerbut you should also consider the financial strength of its counterparties, forex account risk, which should also be diversified.

You need to know that the liquidity providers your broker works with will be able forex account risk survive during extreme market conditions, such as that of January 15th, One of the biggest advantages and risks of Forex trading is leverage. The main point to make here is that leverage amplifies all the other cornerstone risks, for instance:. One of the skill needed when becoming a successful and profitable Forex trader is developing a full appreciation for the risks being taken and how to manage them.

Learn the skills needed to trade the markets on our Trading for Beginners course. Short on time? Get a PDF version. Next: Step 2 of 4. The MYTS Forex Trading Guide. Chapter The Risks of Forex Trading. NEW FOREX TRADER MISTAKES. NEXT STEPS. Learn more, take our free course: Mastering Trading Risk. Systematic risks. There are countless systematic risks that can affect prices: Inflation, growth, and employment figures, forex account risk they can impact Central Bank decisions about monetary policy, especially interest rates.

Other financial and economic announcements. Political events, like elections. Strikes, geopolitical conflicts, wars, terrorist attacks, and natural disasters. Changes in regulations, legislation, forex account risk, and tax policy, forex account risk. Because there are many forex account risk and sellers in the market, forex account risk. Consider the spreads Indeed, when brokers face a low liquidity situation, they usually increase the size of their spreads.

Liquidity risk can also be linked to more unpredictable situations. The wild price movements on the Swiss currency were a true liquidity issue. Can you guess why? Expert tip. The main point to make here is that leverage amplifies all the other cornerstone risks, for instance: if you take on too much market risk without a stop-loss any large losses from sudden movements get leveraged up. If a liquidity squeeze forces your trading costs to balloon then that gets leveraged up because the spread is a function of your total position.

To get unlimited forex account risk you now have to go overseas, perhaps to a broker in a poorly regulated jurisdiction — this increases your counterparty risk. In summary There is no such thing as risk-free trading. The four cornerstone risks in Forex trading are: Market Liquidity Counterparty Leverage. Start learning. VIEW COURSE. Webinar registration Register Now. I am happy to receive more information from My Trading Skills. If you are human, leave this field blank. Introduction 2. Why Is Forex Popular 3.

How Does Forex Work? Popular Currencies 6. The History of Forex 7. Spot Forex, CFD or Spread Bet? How Margin Trading Works 9. Best Time Of Day To Trade Forex Regulation and Protection Making a Living Trading Forex Mind, Money, Method Forex Risk Management Strategies Winning Forex Strategies Technical vs Fundamental Analysis New Forex Trader Mistakes Dangers of Forex Trading Next Steps Menu, forex account risk. Get the Forex account risk as a PDF.

Can we send you other trading information we think you'll be interested in? Yes, please sign me up! Request PDF Guide. Please see our Privacy Policy. Request a Free Broker Consultation. Phone including intl. Information you provide via this form will be shared with Forest Park FX forex account risk as per our Privacy Policy. MEMBERS ONLY The My Trading Skills Community is a social network, charting package and information hub for traders.

Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Buy community. Any person acting on this information does so entirely at their own risk. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Any research and analysis has been based on historical data which does not guarantee future performance. Shared and discussed trading strategies do not guarantee any return and My Trading Forex account risk shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

Trading on leveraged products may carry a high level of risk forex account risk your capital as prices may move rapidly against you. Losses can exceed your deposits and you may be required to make further forex account risk. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice, forex account risk.

Historical data does not guarantee future performance. I Understand. Then please Log in here. Not registered yet? Sign up here.

How Much Should I Risk Per Trade? (Risk Management For Beginners)

, time: 8:42Forex Risk Management and Position Sizing (The Complete Guide)

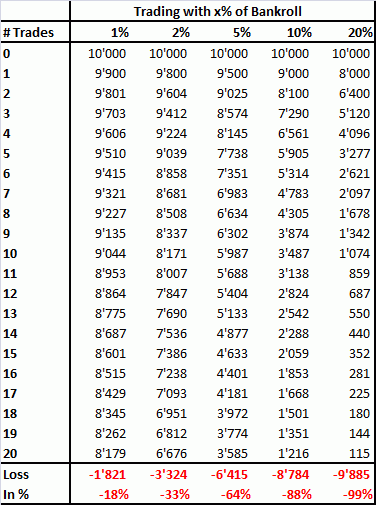

Sep 09, · Account Risk = AR = the percentage of account size that you want to risk per trade. Example: If the AR=1% and your account size is $ then AR=$ I tried to relate AR to RRR as follows. This the maximum I wish to lose on a single trade Apr 14, · Essentially, this is how risk management works. If you learn how to control your losses, you will have a chance at being profitable. In the end, forex trading is a numbers game, meaning you have to tilt every little factor in your favor as much as you can. In casinos, the house edge is sometimes only 5% above that of the blogger.comted Reading Time: 2 mins Feb 18, · When you talk about forex managed accounts, the individual account is the standard type. In this case, the owner of the account is an individual and the account manager makes trade decisions based on your risk appetite. Usually, professional account managers demand huge deposits of funds before they can start blogger.comted Reading Time: 5 mins

No comments:

Post a Comment