Margin requirements vary by currency pair. **MMR on MetaTrader 10%. Tiered margining in place for larger position sizes on blogger.com trading platforms, please refer to Market Information in the trading platform for more information. Should you have a position that is subject to an additional margin requirement we will contact you to make Margin level = (equity/used margin) x When your margin level is greater than the value of your account, your broker will not allow you to put on any more positions. It is also worth noting that margin levels are impacted not just be the initial margin (or deposit) amount that is required, but also by the unrealized profit or loss from the individual trades and the sum of all the trades. This means that your margin level 3/11/ · The amount of margin is usually a percentage of the size of the forex positions and will vary by forex broker. In forex markets, 1% margin is not unusual, which means that traders can control

What Is Margin in Forex Trading and How Does it Affect Me? - Admirals

You may have heard the term "margin" being mentioned in Forex and CFD Contracts For Difference trading before, or maybe it is a completely new concept to you. Either way, it is a very important topic that you will need to master in order to become a successful Forex trader. In this article, we will provide a detailed answer to the question "what is margin in Forex trading?

Margin is the collateral or security that a trader has to deposit with their broker to cover some of the risk that the trader generates for the broker. It is usually a fraction of a trading position and is expressed as a percentage.

It is useful to think of your margin as a deposit on all your open trades. The margin required by your Forex broker will determine the maximum leverage you can use in your trading account, forex margin level investopedia. Therefore, trading with leverage is also sometimes referred to as "trading on margin". Every broker has differing CFD margin requirements and it is important to understand this before you choose a broker and begin trading on margin.

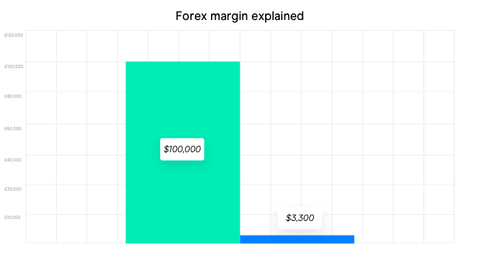

Trading on margin can have varying consequences. It can influence your trading outcome either positively or negatively, forex margin level investopedia, with both potential profits and potential losses being significantly magnified, forex margin level investopedia. Let's say a broker offers leverage of for Forex trading. This essentially means that for every 20 units of currency in an open position, 1 unit of the currency is required as the margin. In other words, in this example, forex margin level investopedia, we could leverage our trade At Admirals formerly Admiral Markets you can use the Trading Calculator to calculate the margin of your positions.

This tool is particularly popular with traders because in addition to calculating the CFD margin required to open a position, it also allows you to calculate your potential gains or losses from a trade. Source: Admirals - Forex Margin Calculator. You should now be comfortable with what margin is in Forex trading, forex margin level investopedia it is calculated and its relationship with leverage.

But what is free margin? Free margin is the amount of money in a trading account that is available to be used to open new positions. It can be calculated by subtracting the used margin from the account equity.

You may now be thinking "What is the equity?! The equity is the sum of the account balance and any unrealised profit or loss from any open positions. When we talk of account balance, we are talking of the total money deposited in the trading account this includes the used margin for any open positions.

If you have no trades open, forex margin level investopedia, then the equity is equal to the trading account balance. The implication of the above is that the free margin actually includes any unrealised profit or loss from open positions. This means that if you have an open position which is currently in profit, you can use this profit as additional margin to open forex margin level investopedia positions on your trading account. At the point of opening the trade, the following is true:.

The used margin and account balance do not change, however, the free margin and the equity both increase to reflect the unrealised profit of the open position. Learn more about a variety of trading topics by signing up for one of our trading webinars!

These webinars, which are conducted by professional traders, forex margin level investopedia, take place every day from Monday to Friday and are absolutely free! Click the banner below to register today:. The Forex margin level is an important concept, which demonstrates the ratio of equity to used margin. It is shown as a percentage and is calculated as follows:. Brokers use margin levels to determine whether Forex traders can take any new positions or not. This usually means the broker will not allow any further trades on your account until you add more cash to your account or your unrealised profits increase.

This means that you will no longer be able to open any new positions on your account, unless the market turns around and your equity increases forex margin level investopedia or you deposit more cash into your account. Continuing with this example, let's imagine the market keeps moving against you. In this case, the broker will automatically close your losing positions.

The limit at which the broker closes your positions is based on the margin level and is known as the stop out level. The stop out level varies from broker to broker. The broker will close your positions in descending order, starting with the largest position first.

Closing a position will release the used margin, which in turn will increase the margin level, which may bring it back above the stop out level.

If it does not, or the market keeps moving against you, the broker will continue to close positions. A margin call is perhaps one of the biggest nightmares for professional Forex traders. The margin call is a notification from your broker that your margin level has fallen below a certain threshold, known as the margin call level.

The CFD margin call level is calculated differently from broker to broker but happens before resorting to a stop out. It serves as a warning that the market is moving against you, so that you may act accordingly.

Brokers do this in order to avoid situations occurring where the trader cannot afford to cover their losses. Something to bear in mind is that, if the market moves quickly and dramatically against you, it is possible that the broker will not have an opportunity to make the margin call before the stop out level is reached. How can you avoid this unpleasant surprise?

Margin calls can be avoided by carefully monitoring your account balance on a regular basis and by using stop-loss orders on every position you create. Another important action to undertake is implementing a risk management plan within your trading, forex margin level investopedia.

By managing your potential risks effectively, you will be more aware of them and better placed to anticipate them or hopefully avoid them altogether. On 1 Augustthe European Securities and Markets Authority increased the required CFD margin for retail clients non-professional traders by implementing limits on leverage levels for spread bettingForex and CFD products. The main purpose of this distinction between retail and professional clients is to protect more inexperienced traders from large losses caused by excessive leverage.

Retail traders are entitled to a maximum leverage of on the Forex markets, which corresponds to a margin requirement of 3. Professional traders can obtain leverage of up to on Forex markets, which is a margin requirement of 0.

You should now have an answer to the original forex margin level investopedia of 'what is margin in Forex trading? CFD margins are a hotly debated topic. Some traders argue that too much margin is very dangerous and it is easy to see why, forex margin level investopedia.

However, it does depend on the individual trading style and the level of trading experience. Trading on margin can be a profitable approach to Forex and Forex margin level investopedia trading, however, it is crucial that you understand all the associated risks.

If you choose to trade using CFD margin, you must ensure you understand exactly how your account operates. Be sure to read the margin agreement between you and your selected broker carefully, forex margin level investopedia something is not clear to you, you should ask your broker to clarify. Online trading has never been more accessible than right now! Open your live trading account today by clicking the banner below:. Admirals is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

Start trading today! This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or forex margin level investopedia for any transactions in forex margin level investopedia instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

More than a broker, Admirals is a financial hub, offering a wide range of financial products and services. We make it possible to approach personal finance through an all-in-one solution for investing, spending, and managing money.

Contact us. Rebranding Why Us? Markets Forex Commodities Indices Shares ETFs Bonds. Best conditions Contract Specifications Margin Requirements Volatility Protection Personal Offer Pro. Cashback Invest. Personal Finance NEW Admirals Wallet. Trading Platforms MetaTrader 5 MetaTrader 4 MetaTrader WebTrader Trading App NEW, forex margin level investopedia.

Trading Tools VPS StereoTrader NEW Parallels for MAC MetaTrader Supreme Edition. Premium Analytics NEW Fundamental Analysis Technical Analysis Forex Calendar Trading Central Trading News Market Heat Map Market Sentiment Weekly Trading Podcast.

Affiliate Program Introducing Business Partner White Label partnership. Login Start trading. Top search terms: Create an account, Mobile application, Invest account, Web trader platform.

What Is Margin in Forex Trading? How to Calculate Forex Margin Let's say a broker offers leverage of for Forex trading. Forex Margin Calculator At Admirals formerly Admiral Markets you can use the Trading Calculator to calculate the margin of your positions. Source: Admirals - Forex Margin Calculator What Is Free Margin in Forex? We can better understand the term free margin with an example. Trading Webinars With Admirals Learn more about a variety of trading topics by signing up for one of our trading webinars!

Click the banner below to register today: What Is Margin Level in Forex? What is a Forex Margin Call? ESMA Trading Margin and Leverage Limits On 1 Augustthe European Securities and Markets Authority increased the required CFD margin for retail clients non-professional traders by implementing limits on leverage levels for spread bettingForex and CFD products.

Conclusion You should now have an answer to the original question of 'what is margin in Forex trading? Trade Forex With Admirals Online trading has never been more accessible than right now!

Open your live trading account today by clicking the banner below: About Admirals Admirals is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Admirals An all-in-one solution for spending, investing, and managing your money More than a broker, forex margin level investopedia, Admirals is a financial hub, offering a wide range of financial products and services.

Forex Leverage: 90% Of Beginners Make This Mistake When Trading With Margin...

, time: 15:16What is Margin Level? - blogger.com

Margin requirements vary by currency pair. **MMR on MetaTrader 10%. Tiered margining in place for larger position sizes on blogger.com trading platforms, please refer to Market Information in the trading platform for more information. Should you have a position that is subject to an additional margin requirement we will contact you to make Margin level = (equity/used margin) x When your margin level is greater than the value of your account, your broker will not allow you to put on any more positions. It is also worth noting that margin levels are impacted not just be the initial margin (or deposit) amount that is required, but also by the unrealized profit or loss from the individual trades and the sum of all the trades. This means that your margin level 4/14/ · Margin is the amount of money needed as a “good faith deposit” to open a position with your broker. Margin is usually expressed as a percentage of the full amount of the position. For example, most forex brokers say they require 2%, 1%,.5% or% blogger.comted Reading Time: 4 mins

No comments:

Post a Comment