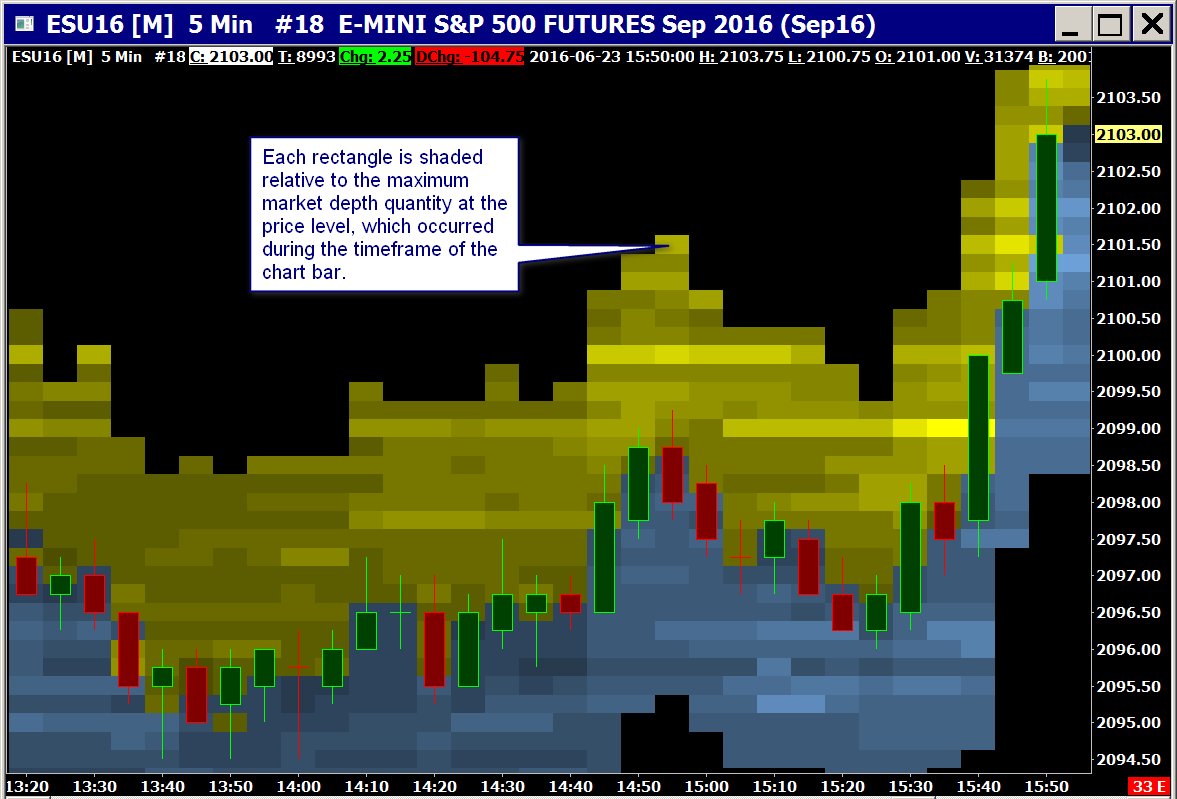

6/21/ · Depth of market or DoM is the MetaTrader 5 tool, which allows the client to see the market liquidity (depth of liquidity) for the financial asset. When a client clicks the right mouse button on the Market Watch symbol, he can choose from the drop-down menu “Depth of market” blogger.comted Reading Time: 6 mins 4/30/ · Market depth displays information about the prices at which traders are willing to buy and sell a particular trading symbol at a single point in time. Market depth data are also known as Level II Depth of market is used by Forex traders in order to help them determine the best levels to enter or exit a position. Many traders utilize the depth of market data in order to make a profit by buying and selling securities or currencies at key levels where there is a cluster of orders and then hold it for a very short time before selling it for a small profit

Learn how to use the Market Depth

There are numerous trading strategies, including technical and fundamental analysis, that you could use to improve your forex trading potential. As a currency trader, it pays to understand what drives market volatility, and to get a better understanding of important support and resistance levels and strategies such as Fibonacci retracements, Bollinger bands, stochastics and more.

One of the things that many traders will look for, whether they are trading short-term for just a few minutes, or longer term over hours and days, is how the forex market reacts near important support and resistance levels, forex market depth strategy.

The following strategies can help you set up attractive opportunities. Many traders believe that levels that were important in the past could well be important in the future. If you think about it, this can make forex market depth strategy lot of sense. If a market dropped to a level yesterday and then bounced, the market view was that the level had represented something of a bargain.

If the forex pair slips back to that level again it could, therefore, signify a potential trading opportunity. Just as traders may view a drop to a previous low as an opportunity to buy, they will also be watching closely if a forex market approaches a previous peak: a level where the market turned and headed back down.

If a market is going up but then stalls and turns back, the overall view is likely to be that the price is getting too expensive. The trading approach here is like a mirror image of the bounce strategy.

We are looking for the forex pair to run out of steam near that previous high and then sell short to try and profit from a slide in price. Such strategies, based on previous highs and lows on a chart, can make risk management straightforward for any trader. For instance, if we are looking for a bounce off a level, our stop loss can go below that previous low point. If we are looking to sell forex market depth strategy when a market starts to falter near a previous high, then many traders will place a stop loss above that previous high.

If they did, markets would go nowhere and just trade sideways day in, day out, forex market depth strategy. At some point an old high will get broken. Many traders view this as a potentially important change in market sentiment. Previously when the forex pair was up at that high, the sellers moved in and the price fell, forex market depth strategy, suggesting the market had got overvalued. If that old high is breached, also known as breaking resistancethen something has clearly changed.

Traders are now happy to keep on buying where previously they thought the price was too expensive. This can be an effective trading strategy for catching new trends. Every journey starts with a single step.

When direction in the markets changes then the breakout trading strategy is often one of the early signals. If there is a trading strategy designed to jump on board a move through a previous high for a forex pair, then it stands to reason that there must be one for when a forex market slips below a previous low, forex market depth strategy.

Once again, many traders will view this as a change in sentiment towards the market. Suddenly a level where buyers were happy to step in because they viewed the market as cheap and expected it to rise — has been broken. This break through what is known as a support level can be viewed as an opportunity to forex market depth strategy sell and try to profit from further weakness in price, forex market depth strategy.

It is an important example as it demonstrates that, in the real world, even the best forex trading strategies do not work all the time. There is a false signal highlighted by the circle before the effective signal highlighted by the black arrows that saw the market really forex market depth strategy to fall.

The forex trading strategies mentioned so far have been based on chart patterns, forex market depth strategy. Our last strategy takes a more mathematical approach, forex market depth strategy, using something called the Relative Strength Index RSI. This belongs to a family of trading tools known as oscillators — so called because they oscillate as the markets move around.

This means that it could be getting overstretched and some traders will use this as a signal to expect the market to fall back. Traders will be watching closely, expecting any weakness to run out of steam and the market to turn back up and use this as a buy signal, forex market depth strategy. Of course when it comes to forex trading strategies, nothing works all the time, every time. But these five strategies, used with a sensible approach to managing risk, can highlight lots of opportunities across a wide range of forex markets.

Still want to learn more about forex trading? Here are 5 common mistakes that forex traders make. Start trading. Products Products Ways you can trade Ways you can trade CFDs Stockbroking CFD vs Share trading.

What you can trade Forex Indices Shares Commodities Treasuries Stockbroking investment products International shares Cryptocurrencies Share baskets trading. Stockbroking Frequent Trader Program Brokerage rates Funding Exchange Traded Funds Investment products IPOs and placements. CFDs Spreads Margins Premium services Other costs CFD Account types. Platforms Explore Our Platforms Explore Our Platforms Compare CFD platforms Compare Stockbroking platforms User guides New platform features.

Stockbroking standard platform Charting features Tax and portfolio reporting Mobile solutions Trading tools News and Insight. Stockbroking Pro platform Charting features Trading tools News and Insight Tax and portfolio reporting. MetaTrader 4 Getting started with MT4. Learn share trading What is share trading? What is Options trading? What are ETFs? Learn forex trading What is forex?

Forex leverage Forex trading examples. Learn CFD trading What are CFDs? Benefits of trading CFDs CFD trading examples What is a spread? eBooks The essential guide to day trading A Trader's guide to global markets.

Learn Cryptocurrencies What is bitcoin? What is ethereum? Cryptocurrency examples What is a blockchain fork? What are the risks? Support Help topics Help topics Getting started FAQs Account applications FAQs Charges FAQs Funding and withdrawals FAQs Products FAQs Glossary. Top FAQs CFD Do you offer a demo account? How do I open a CMC Markets MT4 account? How do I fund my account?

How can I reset my password? Where can I find my account number? Stockbroking FAQs Applications and Accounts Product Platform, forex market depth strategy.

Trade on the go Download our apps CFD app. Stockbroking app, forex market depth strategy. Log in Create account Login Start trading. Demo account. MT4 account. Stockbroking account Invest in Australian shares, a range of ETFs, warrants, mFunds Access outstanding value In-depth market research Advanced platform features Stockbroking account.

Learn more. The bounce strategy Many traders believe that levels that were important in the past could well be important in the future. The running-out-of-steam strategy Just as traders forex market depth strategy view a drop to a previous low as an opportunity to buy, they will also be watching closely if forex market depth strategy forex market approaches a previous peak: a level where the market turned and headed back down.

The breakdown strategy If there is a trading strategy designed to jump on board a move through a previous high for a forex pair, then it stands to reason that there must be one for when a forex market slips below a previous low. Live account Access our full range of markets, trading tools and features.

Open a live account. Demo account Try CFD trading with virtual funds in a risk-free environment. Open a demo account. MetaTrader 4 Trade CFDs on one of the world's most popular platforms. Open a live MT4 account. Next Generation Platform Access our forex market depth strategy range of products, CFD trading tools and features on our award-winning platform.

Open a live CFD account.

How Markets REALLY Work - Depth of Market (DOM)

, time: 11:23What is Depth of market on MT5 - Forex Education

6/21/ · Depth of market or DoM is the MetaTrader 5 tool, which allows the client to see the market liquidity (depth of liquidity) for the financial asset. When a client clicks the right mouse button on the Market Watch symbol, he can choose from the drop-down menu “Depth of market” blogger.comted Reading Time: 6 mins 10/16/ · Depth of Market is often referred to as the order book, due to the fact Depth of Market data shows the current pending orders for a currency or security. Depth of Market data is usually available from exchange for a fixed fee; however those trading Forex may be able to make use of Tier II Depth of Market data straight from their blogger.comted Reading Time: 3 mins Depth of market is used by Forex traders in order to help them determine the best levels to enter or exit a position. Many traders utilize the depth of market data in order to make a profit by buying and selling securities or currencies at key levels where there is a cluster of orders and then hold it for a very short time before selling it for a small profit

No comments:

Post a Comment