Leverage is offered in many instances of capital markets trading, but forex leverage is generally much higher than any other trading vehicle. The leverage that is offered for US equities is These two refer to the same thing – the broker allows the trader to open a position worth times his capital. If we deposit $1,, for instance, and use leverage, we will be able to trade volumes at a value of $, However, there are several additional things Forex traders should be aware of when using leverage Sep 27, · If you use leverage, you will need only $ to make $ which is half of your account. Your broker would require you to put 2% of the position as margin to hold a $50, position. This means you will raise less on your account to hold a position of $50, Of course this is blogger.comted Reading Time: 4 mins

Forex Leverage Explained, and How Much to Use - TradeThatSwing

You are using an outdated browser. Please upgrade your browser to improve your experience. Particularly if you are new to forex trading, you may have asked yourself the question, what is leverage in forex?

As you see the term being used a lot. Here we will explain exactly what it is, how it works, and how you should approach it especially if you have signed up with a High Leverage Forex Brokers to help yourself balance risk and reward. Leverage in forex at its core is essentially borrowing money to invest based on the balance you have in your brokerage account.

This money typically comes from the broker and allows you the ability to open an increased size of a position and amplify your holdings without risking all of your own capital. Naturally, opening these bigger positions will subject you to larger gains but also has the potential to amplify your losses as how does 1 500 leverage work forex. For this reason, it is important you know exactly how to utilize your leverage in a safe way alongside a solid risk management system.

Forex leverage works with the broker e ssentially covering the remaining size of a position you wish to open, how does 1 500 leverage work forex, while you invest a certain amount. There are a couple of things the broker may require since opening a position using leverage is essentially loaning money from them. They may want an overnight commission if you intend on keeping the position open overnight which in itself would generate overnight fees.

They will also set margin limits to ensure the balance of your account remains positive. If the position moves against you then this could lead to a margin call where you are required to deposit more or close the position. If you want to know more on this, then our guide on How does leverage affect forex trading is a great place to get started.

The role of the broker in forex leverage is central. They are the entity that is lending you the money to trade on leverage with. Now, how does 1 500 leverage work forex, how much leverage you can access will depend on the maximum available leverage the broker makes available, and the leverage ratio that you choose.

A very important thing to do is to make sure you are always trading with a regulated broker. Unregulated brokers may well make very high leverage available but this can come with huge risks. Regulated brokers on the other hand will be required to follow strict rules on the amount of leverage they can offer, particularly for traders in the UK, EU, and Australia to non-professional traders.

These restrictions are only in place for your total protection. Our guide on what is the maximum leverage in forex trading is an excellent overview on this issue if you would like to learn more. Of course, the decision on choosing the amount of leverage you need will be up to you, providing it is within the maximum leverage made available by your broker.

This does not mean you should automatically choose the highest leverage though. You need to take into consideration many factors including your trading strategy and goals. You will also want to consider how long you will hold the position. The general rule is that the longer you plan to hold the position, the lower the leverage should be. Scalping is a good example of when traders take advantage of high leverage since they try to exploit very small movements in a short period of time.

For more on scalping forex effectively, you can have a read of our guide on how to scalp forex without getting burned. As mentioned, good risk management is essential in using forex leverage since it can multiply either your profits or your losses. As a result, you will need to have a well-planned strategy in place to help you manage these risks.

The best way to do this is by starting out using only a small amount of leverage. This can allow you to learn and see the impact of leverage.

You should also use the other tools at your disposal like stop-loss orders to prevent any of your positions from running out of control, while a diversified portfolio is also important to ensure you are not overly reliant on just one position for all your funds.

This will really depend on your own situation. As a guide though, it is best to start small. On positions you plan to hold for longer periods this is also the case. You may also find that your leverage access is limited depending on your location, so this should serve as an additional indicator. This is typically very high risk and not recommended in regard to your risk management. Awards Broker Search Comparison CMC Markets vs IG Plus vs Trading eToro vs Trading IG vs XTB IG vs Plus eToro vs XTB IC Markets vs Pepperstone IG vs Oanda XM vs XTB FBS vs OctaFX Forex.

com vs Oanda HotForex vs XM Markets, how does 1 500 leverage work forex. com vs eToro Plus vs Markets. com Vantage FX vs IC Markets AvaTrade vs IG.

ActivTrades review Admiral Markets review Avatrade review AxiTrader review BDSwiss review CMC Markets review Darwinex review EasyMarkets review eToro review FBS review Forex. com review FP Markets review FXCM review FxPro review FXTM review HotForex review IC Markets review IG Markets review Markets. com review NAGA review Oanda review OctaFX review Pepperstone review Plus review Saxo How does 1 500 leverage work forex review Trading Vantage FX review XM review XTB review ZuluTrade review.

USA Canada UK Australia South Africa FCA ASIC CFTC SEC MT4 MT5 cTrader Copy Trading Platforms Social Trading Platforms Ecn Stp Market Maker Low Spread High Leverage Fixed Spread Demo Islamic Micro Low Minimum Beginners Scalping Hedging Automated How does 1 500 leverage work forex Carry Trade Spread Betting.

Awards Broker Search Comparison Broker Reviews Best Brokers Guides Compare List. Compare List, how does 1 500 leverage work forex. COUNTRIES USA Canada UK Australia South Africa WORLD BEST RANKING. PLATFORMS MT4 MT5 cTrader Copy Trading Platforms Social Trading Platforms. TYPE Ecn Stp Market Maker Low Spread High Leverage Fixed Spread. ACCOUNT Demo Islamic Micro Low Minimum Beginners.

ActivTrades review Admiral Markets review Avatrade review AxiTrader review BDSwiss review CMC Markets review. Darwinex review EasyMarkets review eToro review FBS review Forex. com review FP Markets review. FXCM review FxPro how does 1 500 leverage work forex FXTM review HotForex review IC Markets review IG Markets review. com review NAGA review Oanda review OctaFX review Pepperstone review Plus review. Saxo Bank review Trading Vantage FX review XM review XTB review ZuluTrade review.

CMC Markets vs IG Plus vs Trading eToro vs Trading IG vs XTB. IG vs Plus eToro vs XTB IC Markets vs Pepperstone IG vs Oanda. XM vs XTB FBS vs OctaFX Forex. com vs Oanda HotForex vs XM. What is Leverage in Forex?

Here's the answer Anthony Gallagher Last Updated: May 4 min read. Table of contents. Return To Top. May 4 min read, how does 1 500 leverage work forex. May 3 min read. Keeping you better informed Find and compare the best Online brokers for you Help me choose a broker Use Advanced Search.

Trading CFDs, FX, and cryptocurrencies involves a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Your capital is at risk. The present page is intended for teaching purposes only. It shall not be intended as operational advice for investments, nor as an invitation to public savings raising. Any real or how does 1 500 leverage work forex result shall represent no warranty as to possible future performances. The speculative activity in forex market, as well as in other markets, implies considerable how does 1 500 leverage work forex risks; anyone who carries out speculative activity does it on its own responsibility.

Though we may receive a commission from brokers we feature, this does not impact the results of our reviews or rankings which are conducted with complete independence and objectivity, following our own impartial methodology. Help us continue to provide the best free broker reviews by opening your account with our links.

Please read our Advertiser Disclosure to learn more. Broker Search Broker Search Help Me Choose Advanced Search. Broker Comparison Broker Comparison Compare List. Broker Reviews Broker Reviews Guides. Best Brokers Best Brokers. Company About InvestinGoal and our team of experts Contact us 2FC Financial Srl Via Filippo Argelati, 10, Milan, Italy VAT No.

Connect with us. Copyright © InvestinGoal. com — All rights reserved.

This IS WHY Most BEGINNERS Lose Their ACCOUNTS (What Is Leverage?)

, time: 24:32How Does Leverage Work in Forex Trading? - blogger.com

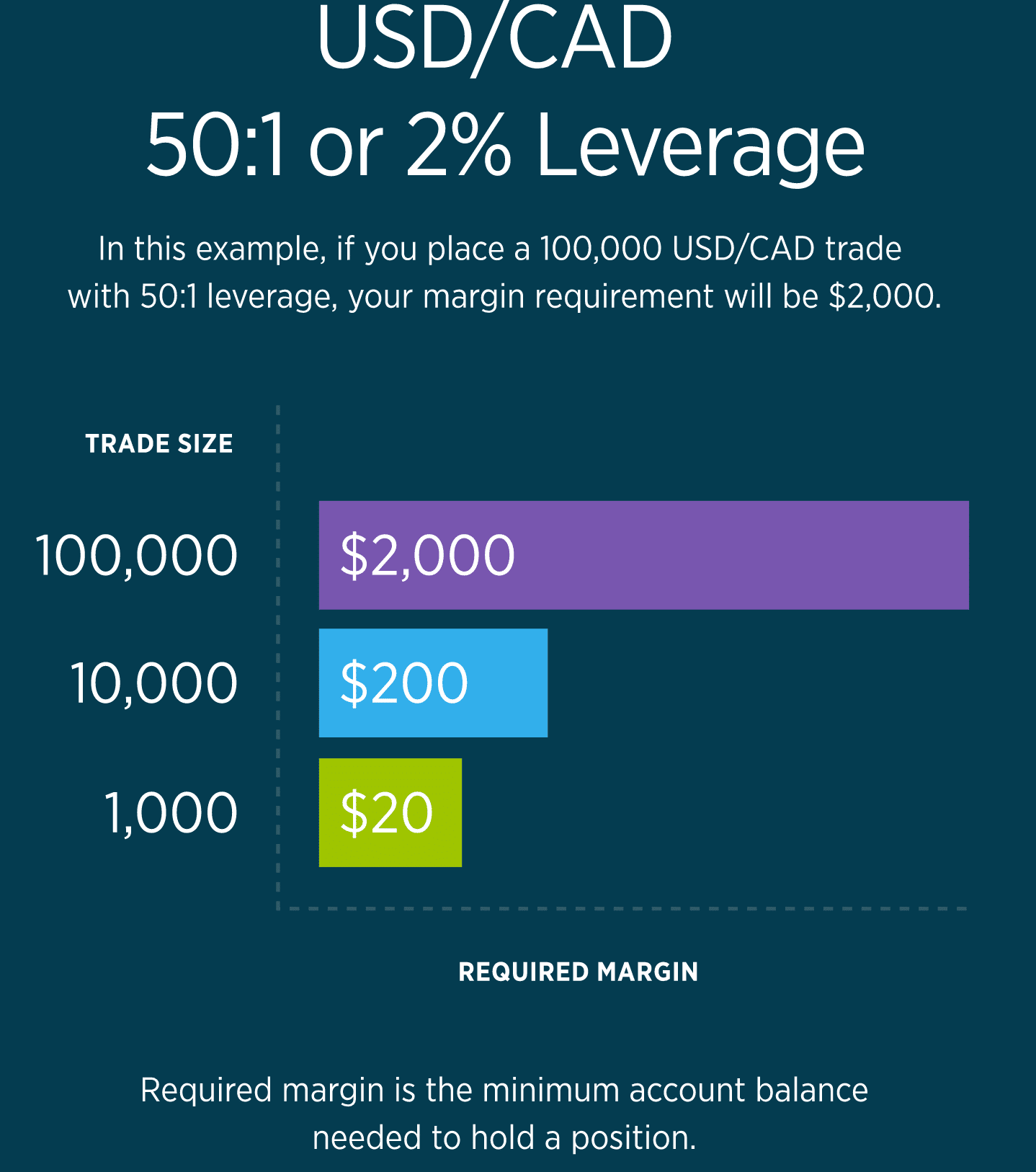

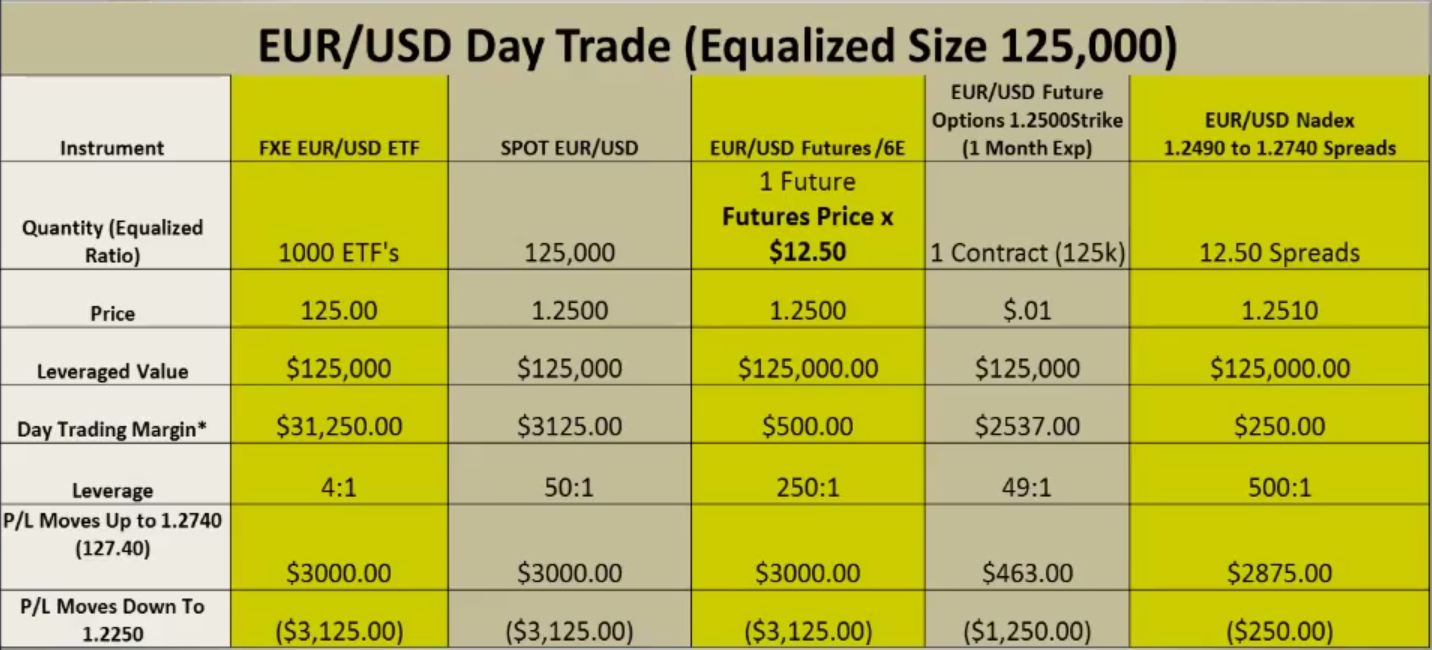

Apr 16, · The leverage ratio provided by brokers usually ranges from to depending on the broker policy and regulation. What purpose does the leverage ratio serve? The leverage ratio actually signifies the minimum margin in forex. If the leverage ratio is , then it signifies that the lowest margin requirement is 2%. Similarly, the margin Estimated Reading Time: 3 mins Apr 27, · If you want to make a thousand dollar trade, you can put in only dollars of your own, and your broker will give you the ability to control the 5 hundred-thousand dollar trade (leverage ). As a result, if you make % return in your thousand dollar trade, that is going to be % return on your own thousand dollar Jul 01, · Leverage allows a Forex trader to increase their position size beyond what they’d normally be able to trade, if they were using only their own account size. Forex brokers offer leverage to their clients in the form of a margin trading accounts. This is where a Forex broker provides access to Estimated Reading Time: 6 mins

No comments:

Post a Comment