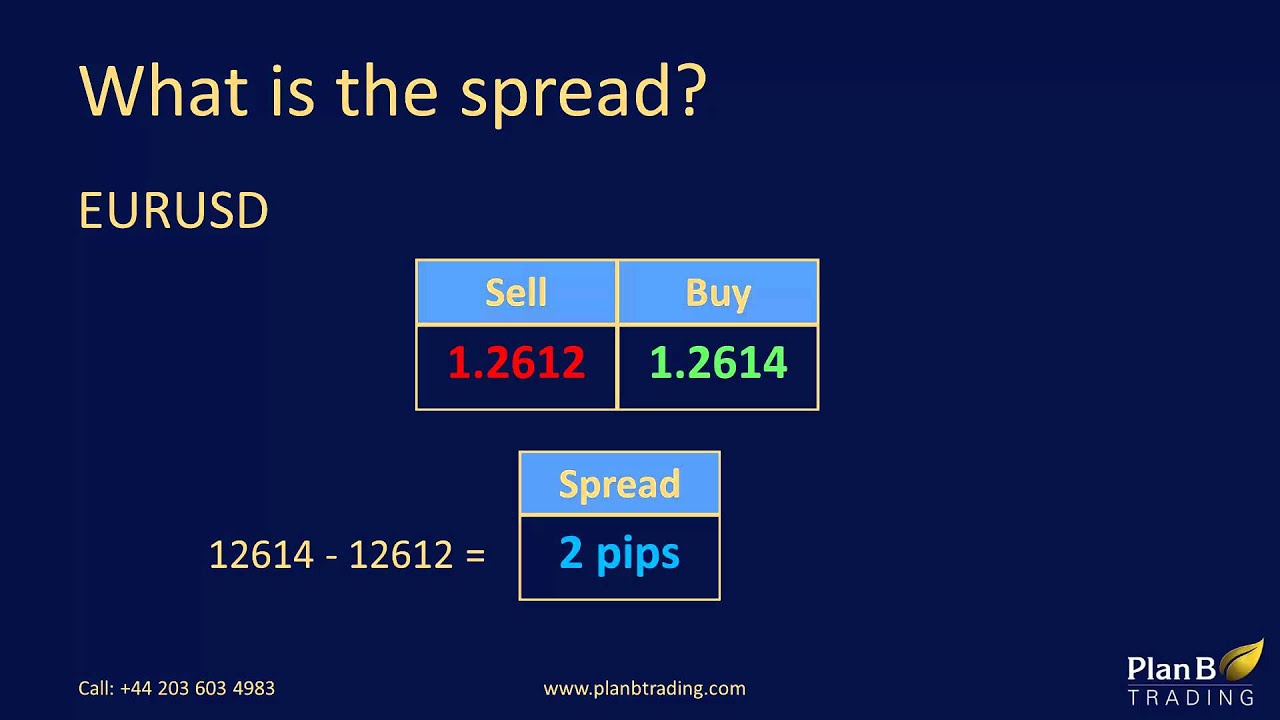

/6/4 · How is the Spread in Forex Trading Measured? The spread is usually measured in pips, which is the smallest unit of the price movement of a currency Estimated Reading Time: 8 mins /6/21 · The exchange rates in the forex market are approximately USD 1 = CAD , and EUR 1 = USD That means the approximate EUR/CAD spot rate /5/12 · In forex trading, the spread refers to the difference between the bid and ask price. It is measured in pips, and one pip is equal to of a currency. So, for example, if the bid price was , and the ask price was , the spread would equal or two pips. Which forex broker has the best spreads?

Forex Trading Fees Guide: What are Swaps & Spreads?

We use a range of cookies to give you the best possible browsing experience. By typical spread in forex to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here, typical spread in forex.

Note: Low and High figures are for the trading day. Forex spreads explain ed : Main t alking points. In this article we explore how forex spreads work, and how to calculate costs and keep an eye on changes in the spread to maximize your trading success.

Every market has a spread and so does forex. A spread is simply defined as the price difference between where a trader may purchase or sell an underlying asset. Traders that are familiar with equities will synonymously call this the Bid: Ask spread. First, we will find the buy price at 1. What we are left with after this process is a reading of. Before we calculate the cost of a spread, remember that the spread is just the ask price less minus the bid price of a currency pair.

So, in our example above, 1. That means as soon as our trade is open, typical spread in forex, a trader would incur 0. To find the total spread cost, we will now need to multiply this value by pip cost while considering the total amount of lots traded. If you were trading a standard lotunits of currency your spread cost would be 0. If your account is denominated in another currency, like GBPyou would have to convert it to US Dollars. This is because the spread can be influenced by multiple factors like volatility or liquidity.

You will notice that some currency pairs, typical spread in forex, like emerging market currency pairshave a greater spread than major currency pairs. Your major currency pairs trade in higher volumes compared to emerging market currencies, and higher trade volumes tend to lead to lower spreads under typical spread in forex conditions.

A high spread means there is a large difference between the bid and the ask price. Emerging market currency pairs generally have a typical spread in forex spread compared to major currency pairs. A higher than normal typical spread in forex generally indicates one of two things, high volatility in the market or low liquidity due to out-of-hours trading. Before news events, or during big shock BrexitUS Electionsspreads can widen greatly.

A low spread means there is a small difference between the bid and the ask price. It is preferable to trade when spreads are low like during the major forex sessions. A low spread generally indicates that volatility is low and liquidity is high.

News is a notorious time of market uncertainty. Releases on the economic calendar happen sporadically and depending if expectations are met or not, can cause prices to fluctuate rapidly. Just like retail traders, large liquidity providers do not know the outcome of news events prior to their release!

Because of this, they look to offset some of their risk by widening spreads. If you are currently holding a position and the spread widens dramatically, you may be stopped out of your position or receive a margin call.

The only way to protect yourself during times of widening spreads is to limit the amount of leverage used in your account. It is also sometimes beneficial to hold onto a trade during times of spread-widening until the spread has narrowed. For more tips on how to successfully navigate the forex spread, take a look at our recommended forex spread trading strategies.

You can also tune into our live trading webinars for daily market insights and trading tips for insights on what may affect the spread, and stay up to date with the latest forex news and analysis. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances, typical spread in forex. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading, typical spread in forex. FX Publications Inc dba DailyFX typical spread in forex registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching your query were found.

English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. BoE Haldane Speech. P: R: 2. Unemployment Rate APR. F: P: R: Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides.

Company Authors Contact. of clients are net long. of clients are net short, typical spread in forex. Long Short. News US Yields Going Which Way? Stocks Keep Climbing; Bitcoin Typical spread in forex in the Sand - The Macro Setup Oil - US Crude.

US Yields Going Which Way? Wall Street. News Dow Jones Steady as Typical spread in forex Stocks Rally, Hang Seng May Rebound News Gold Prices Fall as Moderna Vaccine Optimism Strengthens the US Dollar More View more. Previous Article Next Article. What Does a Forex Spread Tell Traders? Recommended by David Bradfield. Explore how news events can affect your trades, typical spread in forex.

Get My Guide. Foundational Trading Knowledge 1. Forex for Beginners. Forex Trading Basics. Why Trade Forex? Forex Fundamental Analysis. Find Your Trading Style. Trading Discipline. Understanding the Stock Market.

What Are Spreads In Forex? (EVERYTHING YOU NEED TO KNOW)

, time: 15:21What is a Spread in Forex Trading? - blogger.com

Click on a flag to see what event caused the related spike. Date time labels indicate the end of a 15 minute period and are in your browser's timezone. The Live Quote is updated every 5 seconds. The Historical Spreads graph is updated every hour /2/14 · Every market has a spread and so does forex. A spread is simply defined as the price difference between where a trader may purchase or sell an Author: David Bradfield /5/12 · In forex trading, the spread refers to the difference between the bid and ask price. It is measured in pips, and one pip is equal to of a currency. So, for example, if the bid price was , and the ask price was , the spread would equal or two pips. Which forex broker has the best spreads?

No comments:

Post a Comment