12/6/ · UK financial watchdog proposed capping leverage at a maximum level of and setting even lower leverage limits of for inexperienced retail clients with less than 12 The total value of the position is $, (, x ). The equivalent of $ would therefore be allocated from your account to open the position ($, x %). Keep in mind that when you have open positions, your margin requirement for those positions will adjust to the current market pricing Forex Foreign exchange, or forex, is the buying and selling of currencies with the aim of making a profit. It is the most-traded financial market in the world. The relatively small movements involved in forex trading mean that many choose to trade using leverage

8 Best Forex Brokers With High Leverage [ to ]

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. We use a range of cookies to give you the best possible browsing uk forex leverage limit. By continuing to uk forex leverage limit this website, uk forex leverage limit agree to our use of cookies. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any uk forex leverage limit on our site.

View more search results. Leveraged products, such as spread betting and CFDs, magnify your potential profit — but also your potential loss. Call or email newaccountenquiries. uk ig. com to talk about opening a trading account, uk forex leverage limit.

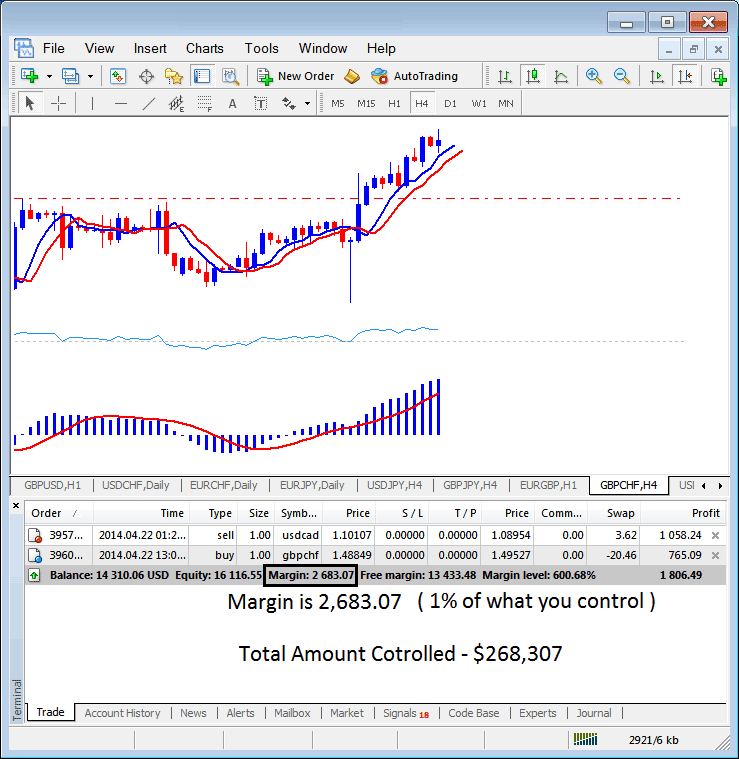

Contact us: Leverage is a key feature of CFD trading and spread betting, and can be a powerful tool for a trader. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Your total exposure compared to your margin is known as the leverage ratio. To open a conventional trade with a stockbroker, you would be required to pay x p for an exposure of £ ignoring any commission or other charges.

If the market had gone the other way and shares of the company had fallen by 20p, uk forex leverage limit, you would have lost £, or a fifth of what you paid for the shares, uk forex leverage limit.

If the shares had fallen by 20p then you would have lost £, which is twice your initial deposit. Find out more about how leverage affects your trading.

The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, uk forex leverage limit, rather than owning the asset itself. A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction — but more loss if it goes the other way.

An agreement with a provider to exchange the difference in price of a particular financial product between the time the position is opened and when it is closed.

Visit spread betting vs CFDs to learn more about the differences between these products. There are lots of other leveraged products available, such as optionsfutures and some exchange traded funds ETFs. Though they work in different ways, all have the potential to increase profit as well as loss. Provided you understand how leveraged trading works, it can be an extremely powerful trading tool.

Here are just a few of the benefits:. Though spread betting, CFDs and other leveraged products provide traders with a range of benefits, it is important to consider the potential downside of using such products as well.

Here are a few key things to consider:. Leveraged trading can be risky as losses may exceed your initial outlay, but there are numerous risk-management tools that can be used to reduce your potential loss, including:.

Attaching a stop to your position can restrict your losses if a price moves against you. If your stop is triggered, there will be a small premium to pay in addition to normal transaction fees. UK regulation ensures you cannot lose more than the equity available on your account. Using stops is a popular way to reduce the risk of leverage, but there are numerous other tools available — including price alerts and limit orders.

Your leverage ratio will vary, depending on the market you are trading, who you are trading it with, and the size of your position. This gives a leverage ratio of Often the more volatile or less liquid an underlying market, the lower the leverage on offer in order to protect your position from rapid price movements.

On the other hand, extremely liquid markets, such as forex, can have particularly high leverage ratios. When researching leveraged trading providers, you might come across higher leverage ratios — but using excessive leverage can have a negative impact on your positions. Interested in opening an account? Contact or newaccountenquiries. Email newaccounts. IG Sitemap Terms and agreements Privacy IG Community Cookies Investors Modern slavery act. Professional clients can lose more than they deposit.

All trading involves risk, uk forex leverage limit. The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting uk forex leverage limit less than you originally put in.

Past performance is no guarantee of future results. CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd a company registered in England and Wales under number and IG Index Ltd a company registered in England and Wales under number Registered address at Uk forex leverage limit Bridge House, 25 Dowgate Hill, London EC4R 2YA, uk forex leverage limit. Both IG Markets Ltd Register number and IG Index Ltd Register number are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Careers Marketing partnership. Inbox Community Academy Help. Log in Create live account. About us About us How we support you What we do with your money How does IG make money?

Professional uk forex leverage limit Compare our international offering Best execution Ways to trade Ways to trade Spread betting CFD trading Spread betting vs CFDs Our charges Create an account Ways to invest Ways to invest Share dealing Smart Portfolios ISAs ETFs Markets to trade Markets to trade Forex Indices Shares Commodities Options trading Futures trading Spot trading Other markets Weekend trading Out-of-hours trading Volatility trading Market data Trading platforms Trading platforms Mobile trading Trading signals Trading alerts DMA trading Algorithmic trading APIs ProRealTime MetaTrader 4 L2 Dealer Compare platforms Try our platform Analyse and learn Analyse and learn Managing your risk Maximising trading success How to trade online Trade analytics tool News and trade ideas Strategy and planning Financial events Seminars and webinars Subscriptions and downloads Special reports Trading podcasts Investing podcasts Economic calendar Glossary of trading terms.

Related search: Market Data. Market Data Type of market. Analyse and learn Managing your risk What is leverage? The impact of leverage on your trading. What is leverage? Interested in spread betting with IG? Find out more. Practise on a demo. How does leverage work? Different types of leveraged products The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, rather than owning the asset itself.

The main leveraged products are:. Spread betting UK only A bet on the direction in which a market will move, which will earn more profit the more uk forex leverage limit market moves in your chosen direction — but more loss if it goes the other way.

More about spread betting with IG. Contracts for difference CFDs An agreement with a provider to exchange the difference in price of a particular financial product between the time the position is opened and when it is closed. More about trading CFDs with IG.

Which markets can you use leverage on? Some of the markets you can trade using leverage are: Shares A share is a unit of ownership for a particular company, and is usually bought and sold on a stock exchange. You can use leveraged products to open positions on thousands of shares, from blue chips like Apple and Facebook, to penny stocks. Indices An index is a numerical representation of the performance of a group of assets from a particular exchange, area, region or sector.

As indices are not physical assets, they can only be traded via products that mirror their price movements — including spread betting, CFD trading and ETFs. Forex Foreign exchange, or forex, is the buying uk forex leverage limit selling of currencies with the aim of making a profit. It is the most-traded financial market in the world, uk forex leverage limit. The relatively small movements involved in forex trading mean that many choose to trade using leverage.

More about the markets you can trade using leverage. Benefits of using leverage Provided you understand how leveraged trading works, it can be an extremely powerful trading tool. Here are just a few of the benefits: Magnified profits. You only have to put down a fraction of the value of your trade to receive the same profit as uk forex leverage limit a conventional trade. As profits are calculated using uk forex leverage limit full value of your position, margins can multiply your returns on successful trades — but also your losses on unsuccessful ones.

See an example of magnified profit Gearing opportunities. Using leverage can free up capital that can be committed to other investments. The ability to increase the amount available for investment is known as gearing Shorting the market. Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising — this is known as going short.

Though trading hours vary from market to market, certain markets — including key indices and forex markets — are available to trade around the clock. Drawbacks of using leverage Though spread betting, CFDs and other uk forex leverage limit products provide traders with a range of benefits, it is important to consider the potential downside of using such products as well. Here are a few key things to consider: Magnified losses. Margins magnify losses as well as profits, and because your initial outlay is comparatively smaller than conventional trades, it is easy to forget the amount of capital you are placing at risk.

No shareholder privileges. When trading with leverage you give up the benefit of actually taking ownership of the asset. For instance, uk forex leverage limit, using leveraged products can have implications on dividend payments.

Instead of receiving a dividend, the amount will usually be added or subtracted to your account, depending on whether your position is long or short. Margin calls. If your position moves against you, your provider may ask you to put up additional funds in order to keep your trade open. Funding charges.

Is Forex Trading Haram or Halal? - An Insider View

, time: 9:27How Leverage Works in the Forex Market

FXCM UK offers different leverage for different tradeable instruments. leverage restriction for major currency pairs. for non-major currency pairs, gold and major indices. for commodities other than gold and non-major equity indices. for blogger.comted Reading Time: 5 mins Forex Foreign exchange, or forex, is the buying and selling of currencies with the aim of making a profit. It is the most-traded financial market in the world. The relatively small movements involved in forex trading mean that many choose to trade using leverage 6/15/ · The best FCA regulated UK high leverage forex broker is ThinkMarkets. It should be clarified that the Financial Conduct Authority (FCA) limits leverage for all retail traders including: Major Currency Pairs – maximum leverage of , margin requirements of %Estimated Reading Time: 8 mins

No comments:

Post a Comment